#1 Why take this course?

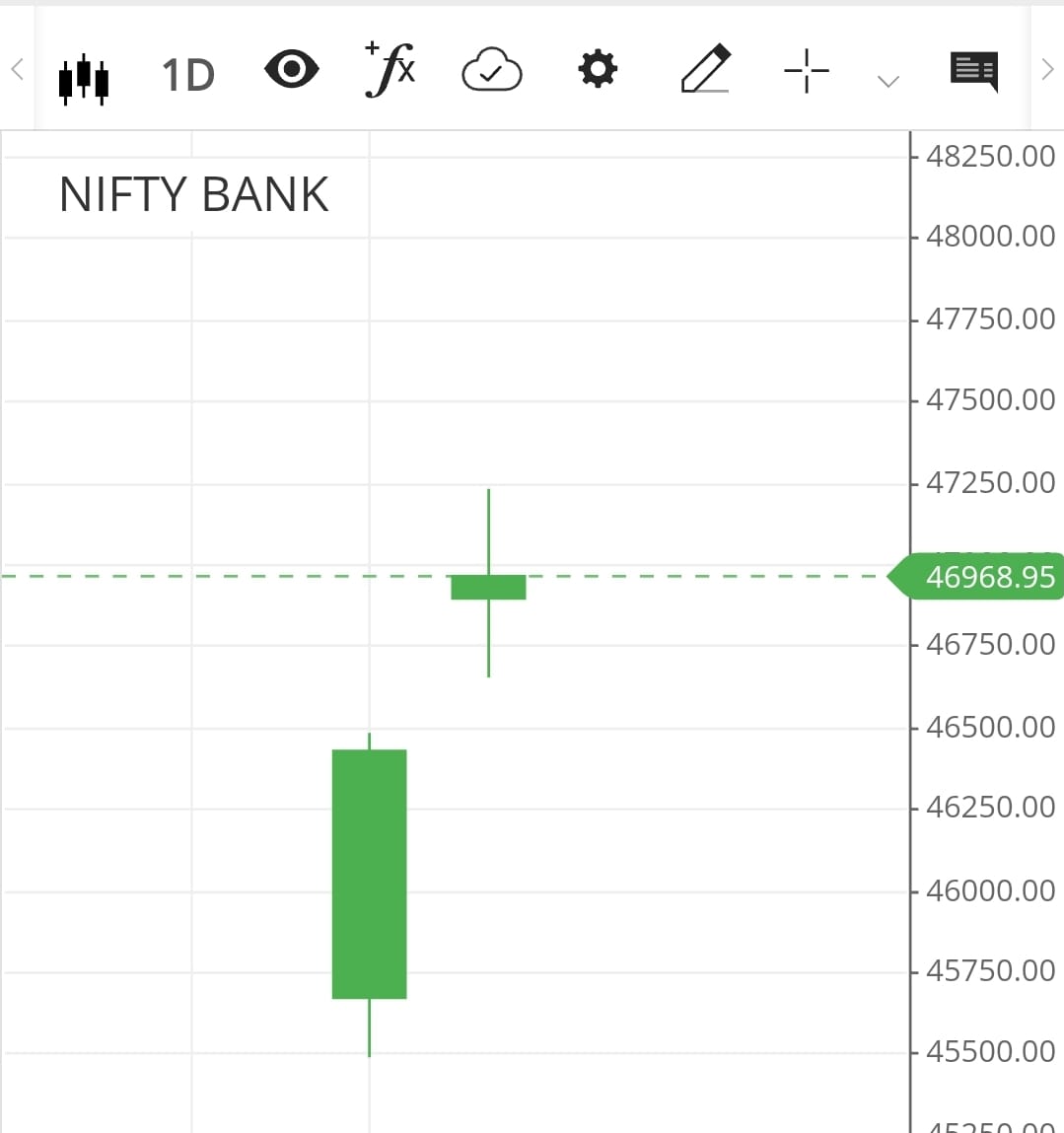

Market Understanding: A deeper understanding of market dynamics gained through a trading course can help you identify trends, patterns, and potential market opportunities. This understanding may contribute to more successful trades and investment decisions.